新型コロナウィルスがサブサハラ地域のアフリカ諸国に及ぼす負の影響と、政府ならびに企業に求められる対応

2021.02.18

Cover photo: World Bank Collection by Sambrian Mbaabu licensed under CC BY 2.0

本記事は、新型コロナウィルス(COVID-19)がサブサハラ地域のアフリカ諸国に及ぼす経済的な負の影響と、その是正に向け政府ならびに企業に求められる対応について述べています。COVID-19の感染拡大により国際市場における需要と供給が減少し、これが同地域諸国に暮らす家庭の平均収入を押し下げる中、人々は少しでも収入を確保しようと感染リスクにも拘わらず日々職場へと出向いています。論説者は、同地域諸国の経済回復に向け求められる対応として、債務救済やデジタル化、リモート化の推進といった短期的な取り組みに加え、ビジネスモデルの抜本的な革新など長期的視点での対策の必要性を挙げています。そして、具体的な取り組みにおいては、アフリカに暮らす人々の旺盛な起業精神と、次代を担う多くの若者そして女性のニーズを十分考慮したうえで、国内外からの投資拡大に注力することが重要だとしています。

By Frank Hartwich and Massoud Hedeshi

April 2020

This opinion piece is part of a series of articles by UNIDO’s Department of Policy Research and Statistics and benefitted from the support and contributions of the Africa Regional Division and UNIDO Field Offices in the region.

Key Messages:

- Despite global trends in COVID-19 containment, most people in SSA may have no realistic option but to continue working and engaging in business activities for their day-to-day survival.

- Significantly lower international market demand and supply of goods and services, coupled with losses in household incomes, will have severe effects on the region’s industry.

- Short-term measures to rescue firms, especially MSMEs, include debt relief and subsidies that also support continued employment of low-wage workers, women, youth, refugees, ex-combatants, etc. as well as the repurposing and digitalization of business operations. Informal businesses and vulnerable groups need to also be supported through direct cash transfer programmes.

- Longer term measures should include support for reorientation and the development of new business models with different product mixes, local and regional sourcing of inputs, infrastructure development, and greater collaboration and innovation among firms in partnership with regional development organizations.

- Recovery strategies will need to tap into the continent’s entrepreneurial capacities, with a focus on youth and women, and mobilize domestic and international support to boost innovation and investment.

This opinion paper discusses the likely effects of the COVID-19 pandemic on industry and the economy, which in the SSA context, has the potential of putting people’s lives at equal risk as contracting the virus. On this basis, the article develops policy recommendations that are likely to mitigate the effects of COVID-19 in the short and medium term, and ensure the necessary continuation and reshaping of industrial businesses given the region’s poverty and dependence on foreign markets.

Sub-Saharan response to COVID-19

The COVID-19 infection rates in sub-Saharan Africa (SSA) have remained modest so far. (According to the WHO COVID-19 Situation Report of 29 April, the total number of COVID-19 cases reported in SSA is close to 20,000, with around 500 fatalities. There are concerns about the accuracy of those figures as medical infrastructure for testing and diagnoses is not widely available across the region.) But with notoriously underfunded health systems (according to a recent not yet confirmed WHO survey including 41 African countries, the average number of ICU beds per 1 million Africans is 5 compared to the OECD’s 3,500) and the prevalence of other endemic diseases such as HIV and malaria, many analysts believe that the worst is still to come when the regional pandemic reaches its peak which is expected this summer. On the other hand, previous regional experience with Ebola and HIV containment efforts will help enhance response efforts.

Virtually all countries in SSA have already introduced containment measures. In fact, the region—hosting 33 of the world’s 47 LDCs—responded promptly. The governments of 15 SSA countries closed their airports, ports and land borders before any coronavirus cases had been confirmed, and by the end of March, 44 SSA countries had closed their schools, banned public gatherings, or put in place other social distancing measures; 11 countries declared a state of emergency.

The extent to which these measures are and can be enforced in the region remains to be seen, however. OECD-like approaches to COVID-19 containment measures are not likely to prove effective for the poor and marginalized groups because of a) higher dependence by most households on daily income; b) insufficient government resources to compensate those affected by the containment measures; and c) the difficulty of implementing social distancing in societies where social interaction is a matter of daily survival, let alone the realities of sprawling shanty towns and refugee/IDP camps.

With regard to healthcare measures, the response in the region includes increased sectoral budgets and accelerated efforts to source medical supplies as well as mobilizing health services with outside—mostly WHO—aid. Countries have also responded to rising food security risks. For example, Niger has introduced “distribution of food from the strategic reserve”. Rwanda has begun “door-to-door provision of rice, beans, and flour every three days”, and in the Gambia, the prices of essential goods have been frozen for food commodities such as rice, meat, fish, cooking oil but also for soap, sanitizers and cement.

On the economic side, the focus has been on a mix of monetary and fiscal measures to solve the need for cash of companies and households that have been impacted the most by COVID-19 containment measures. (On 26 March 2020, the African Union established the Covid-19 Response Fund, with members pledging USD 12.5 million. The World Bank and IMF have also allocated USD 18 billion each for Africa’s COVID-19 recovery while the African Development Bank announced a USD 19 billion “Response Facility” on 8 April.) However, an analysis of the scope of such packages reveals their limits: while by 2 April, OECD countries had introduced macro-economic stimuli in the amount of 10 per cent of their GDP on average, the rates in countries such as Rwanda, Kenya, Ghana and Nigeria only ranged from 0.6 per cent to 1.1 per cent of GDP.

Impacts on industry and households

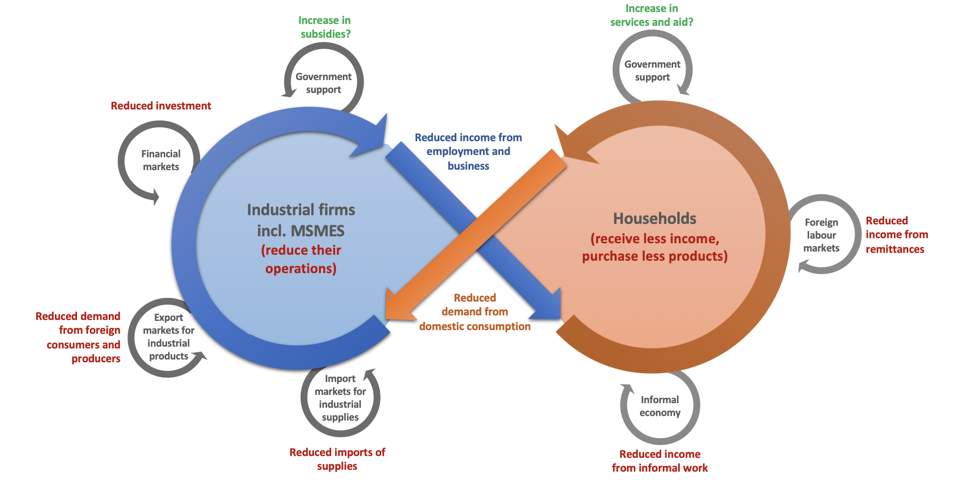

Against such a debilitating backdrop (according to the estimations of the World Bank, the pandemic will cost SSA between USD 37 billion and USD 79 billion in output losses for 2020), SSA industries will not only be heavily impacted by COVID-19 containment measures at home but also by those that have been implemented abroad. Due to lower global demand, the region will likely see a reduction in key industrial inputs and outputs. The effects are multiple and circular in nature (see effects marked in red in Figure 1).

Industrial firms will simultaneously experience a drop in domestic sales and exports (due to lower demand, reduced prices for commodities and decreased production), shortages in supplies (because suppliers located in other countries are affected by COVID-19 containment measures at home), investments (due to higher risk aversion of foreign investors) and labour (people not allowed to work and move during the lockdown period). At the same time, households are restricted in their economic activity; they provide less labour and hence receive less income from labour, businesses and remittances, and consequently consume less due to their decreasing purchasing power. The impact on local industries thus increases income and food insecurity.

Source: Authors

While these circular effects may hold true for all countries affected by COVID-19, the distinctiveness of SSA lies in its dependence on a) exports of raw materials and imports of supplies and consumer goods; b) foreign direct investments (FDI), debts and aid; and c) income of households from informal activity and remittances. Whether government support is able to match these losses is to be seen.

a) Dependency on exports and imports

Many of the region’s countries share the common characteristics of low levels of income and resources and relatively low engagement in world trade. (According to the UN Financing for Sustainable Development Report 2019, SSA accounts for 12 per cent of the world population but only makes up less than 1 per cent of global trade.) The share of both imports and exports in GDP of most SSA countries hovers around 30 per cent, with one group of countries being even less integrated and a small group with imports and exports above 50 per cent (see Figure 2). Notably, the limited trade SSA countries engage in is crucial to their economies; if it decreases, the trickle-down effects will seriously affect the economies.

Figure 2: SSA dependence on international trade

(2018 imports and exports of goods and services in % of GDP)

Source: Calculations based on figures from wits.worldbank.org

Note: Not all SSA countries are included due to lack of 2018 data

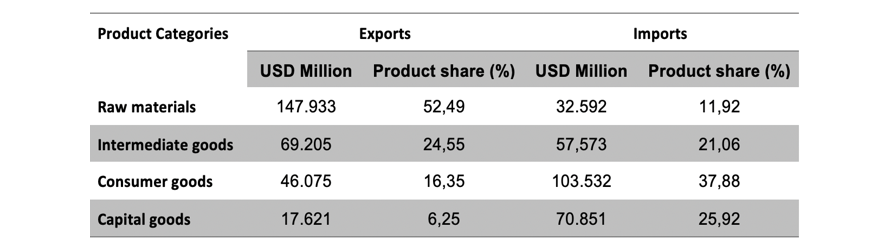

LDCs’ industries are additionally suffering because of their dependence on exports of primary commodities, which constitute the largest share of LDC exports in (unequal) exchange for imports of consumer, capital and intermediate goods from their trading partners, with resultant widening trade deficits and debt dependence (see table below). Finally, SSA countries are dependent on a few trading partners (according to WITS.worldbank.org, SSA primarily imports goods from China (13 per cent), India, the Netherlands, the U.S. and South Africa, while it primarily exports goods to China (17 per cent), South Africa, India, the U.S. and Germany) whose industries have been affected by COVID-19 containment measures as well, and levels of interregional trade are low. (According to UNCTAD, intra-African exports accounted for less than 17 per cent of the continent’s total exports in 2017 (the comparable figures for Europe and Asia were 68 per cent and 59 per cent, respectively)).

Table: Sub-Saharan Africa’s exports and imports by product group (2018)

Source: WITS.worldbank.org

b) Dependency on foreign direct investment, debt and aid

FDI flows to SSA countries are low by global standards, but high in terms of their ratio to domestic GDP, signalling the importance of FDI for the region’s economic growth, where local investment capacities are usually limited. According to the UN (2020), the tendency of SSA LDCs’ FDI share is declining; FDI flows to the region compared to those for all LDCs fell by 50 per cent between 2015 and 2018. In view of COVID-19 and tendency to ‘reshore’ production, it can be expected that FDI will drop even further.

With regard to aid, LDCs receive less than 10 per cent of total aid available for developing countries. Dependence on aid is on the rise, accounting for a significant share of LDCs’ state budgets. For example, according to the World Bank (2020), in 2010, SSA’s total external debt stock (excluding high-income countries) was around USD 300 billion (with interest payments for long-term loans of USD 4 billion). By 2018, it had grown to almost USD 600 billion (with interest payments for long-term loans of almost USD 17 billion). Furthermore, a larger share of the debt is owed to private lenders at higher interest rates.

c) Household dependence on informal sector and remittances

The SSA region is also distinct with regard to the dependence of its households on income from the informal sector and on remittances.

The labour participation rate in the informal sector (including agriculture) in LDCs is estimated at 89 per cent, with a slightly larger share of women than men. Sprawling shanty towns host 60 per cent of all urban LDC populations and make up even more refugee/IDP camps. Households in shanty towns typically exceed five members who mostly live on less than USD 2 a day in single rooms, working in the informal sector with meagre savings. Often, they have to rely on local and international NGOs for food, education, health and/or income assistance. Clearly, people who work in the informal sector are severely affected by COVID-19 containment measures prohibiting free movement. The extent to which social distancing measures can prevent them from pursuing their daily survival activities is debatable.

In countries like Nigeria, for example, remittances actually dwarf the income from FDI and oil revenues. Due to COVID-19, the incomes of SSA households are also likely to decrease due to less money being sent home by migrants who themselves are facing reduced incomes in their host countries. (Due to the effects of COVID-19 on the economy of the United States, China and high-income countries in the Middle East and Europe, remittances to sub-Saharan Africa will fall by 23.1 per cent from USD 48 billion in 2019 to USD 37 billion in 2020.) Migrants are often the first to be laid off, and at times even have to return to their home countries. The World Bank claims that the remittances lost due to COVID-19 could further increase the share of the poor by 5 percentage points in Ghana, and by 11 percentage points in Uganda, for example.

Policy options

What are the implications for SSA industries? COVID-19 containment measures may cause many informal businesses and smaller companies to drop out of production and face bankruptcy while households face reduced income and poverty. These events will hit the economies in SSA hard, likely leading to a downward spiral with intensifying impoverishing effects and the first recession in SSA in the last 25 years. (Between 400 million and 600 million people in developing countries could be pushed into poverty as a result of the great lockdown. Over one-third of these people live in sub-Saharan Africa. According to the World Bank, 23 million of the people projected to be pushed into poverty worldwide due to COVID-19 live in sub-Saharan Africa.)

In consequence, accelerated structural change could result in larger and international companies taking over those parts of production normally carried out by local businesses. This bears the risk that countries will deindustrialize too early, thereby losing important incomes and employment in industry. Meanwhile, there may be a tendency by global players and companies in industrialized countries to move parts of their production closer to “home”, causing SSA industries to become even more marginalized, thus capturing even less value in global production and trade.

Especially vulnerable groups, including women, youth, refugees, workers, ex-combatants, etc., will be particularly affected as they find themselves losing their jobs, income and food security. Many households are likely to experience “food consumption gaps” (due to rising poverty, the UN World Food Programme warns that an additional 130 million lives and livelihoods will be at risk due to COVID-19 impacts) because locally and internationally produced foods do not reach consumer markets, because prices are rising and the purchasing power of households is shrinking.

The above calls for clear policy actions:

Manufacturers can be supported in the repurposing of production and could engage in the manufacturing of medical equipment and devices such as masks, gloves, sanitizers, hospital wear, beds and ventilators. (South Africa, for example, is working on producing 10,000 ventilators by the end of June while Liberia is pursuing an initiative to produce locally-made reusable masks and in Kenya, a factory has transformed into a surgical mask assembly line.) Support can be provided in the form of quality control, debt and tax relief, lower utility and rent costs or access to loans/investments for reorganizing production and providing guarantees for procurement. However, as important as such measures are, one needs to acknowledge that they only constitute a small portion of the relief required for SSA’s industrial sector as a whole.

Other measures to consider are improving the ease of doing business in times of social distancing. Appropriate technology should be promoted that allows remote working, e-commerce and online networking. For that purpose, digital infrastructure and online connectivity need to be improved and extended.

Debt relief for businesses that fall into negative revenue traps due to COVID-19 must be considered as well. Such measures—already being widely applied—include guarantee funds and credit

programmes as suggested by the IMF, but should also include more fiscal stimulus such as writing off of debts and subsidies via standard tax and duty exemptions and cost-cutting initiatives (rents, utilities, etc) for the companies most affected. Without debt forgiveness (rather than a partial, one-year deferment already agreed with the G20) and urgent support from donors and development agencies, some SSA countries may not be able to implement the necessary COVID-19 containment measures as well as economic mitigation and recovery efforts.

However, helping companies write off losses alone may not suffice in promoting economic regeneration. In fact, many analysts emphasize the importance of enabling business continuity and assisting enterprises in laying the foundation for recovery. Immense efforts need to be made to re- and further engage companies in businesses and explore different products and markets, and to not leave all the space to global players. This represents an opportunity for the region to diversify and reorient its product mix and introduce new technologies and innovation. Moreover, the channels from which they source supplies could become less import-dependent and more resilient to disruptions in global value chains.

To achieve such a reorientation of industries, SSA countries need to mobilize innovations and investments and integrate them into new business models with a strong focus on women and youth (see, for example, the UN Initiative Women rise for All), and a drive to grow the economy’s formal and informal sectors. Training, technology exchange and investment promotion are important policy measures that can reinforce this process. With 60 per cent of their populations below the age of 25, SSA countries can also draw on this dynamic asset to mobilize innovative entrepreneurial capacities to reorient production. The availability of credit for youth and women entrepreneurs can pay significant dividends in recovery terms.

Governments could use this opportunity to lead industry in a new direction, but may find themselves overwhelmed by the monumental tasks that lie ahead. Therefore, and in line with recommendations from the African Union, the crafting of a regional agenda for industrial revival in view of COVID-19’s effects needs to become a top priority for leaders in SSA. This new action plan needs to go beyond the short-term agenda of solving businesses’ debt crunch and should build on opportunities to diversify the economy, anticipate changes in the global structure of trade and industry, as well as undertake efforts to accelerate regional integration, exploiting the momentum of the African Continental Free Trade Area (according to the WEF 2020, by removing tariffs and other trade barriers, the agreement can foster significant growth in trade, investment and employment across the continent) and the UN COVID-19 recovery strategies. The Regional Economic Communities, potentially with support from UNIDO which has a lead role in the implementation of the Third Industrial Development Decade for Africa (IDDAIII), should be given a prominent role in the implementation of the regional agenda. Such a revival should also build on a strengthened multi-stakeholder partnership approach with greater involvement of the private sector.

Finally, all government support needs to be coupled with debt relief for SSA countries to free fiscal flexibility for support of industries as well as of the wider and vulnerable populations to prevent a drastic drop in living standards and ensuing social unrest.

Disclaimer: This opinion piece provides information about a situation that is rapidly evolving. As the circumstances and impacts of the COVID19 pandemic are continuously changing, the interpretation of the information presented here may also have to be adjusted in terms of relevance, accuracy and completeness. The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).