From health emergency to economic crisis

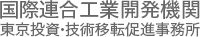

Measures to contain the spread of COVID-19 are threatening to throw the world into one of the worst economic recessions in recorded history. Chinese gross domestic product (GDP) plummeted between 10 per cent to 20 per cent in January-February 2020.1 Similar recessionary effects have begun to emerge in Europe. For example, Germany’s GDP could fall to between -2.8 per cent and -5.4 per cent in 2020.2Several countries have recorded a slowdown in manufacturing activity during the first months of 2020; for many, dynamism has nose-dived in annual terms, relative to 2019 (Figure 1).

STI activities are at the frontlines in the fight against COVID-19. Multiple stakeholders are joining forces at the global level to find a vaccine and to ensure fair access to it for all populations3 , while others are seeking innovative solutions to the challenges associated with the virus4 . Governments have issued special regulations to lure companies into repurposing production, or have allocated dedicated funding to mobilize domestic productive and technological capabilities to address the shortages of COVID-19-related supplies. Firms and industry associations are flaunting their ability to win technology races around COVID-19 supplies.5 There is an abundance of examples of how STI is contributing to the management of the COVID-19 outbreak in both developed and developing countries. In the medium- to long-run, STI should also contribute to economic restructuring, productive diversification and insertion in a changed landscape of global value chains.

Is the effervescence around STI sustainable?

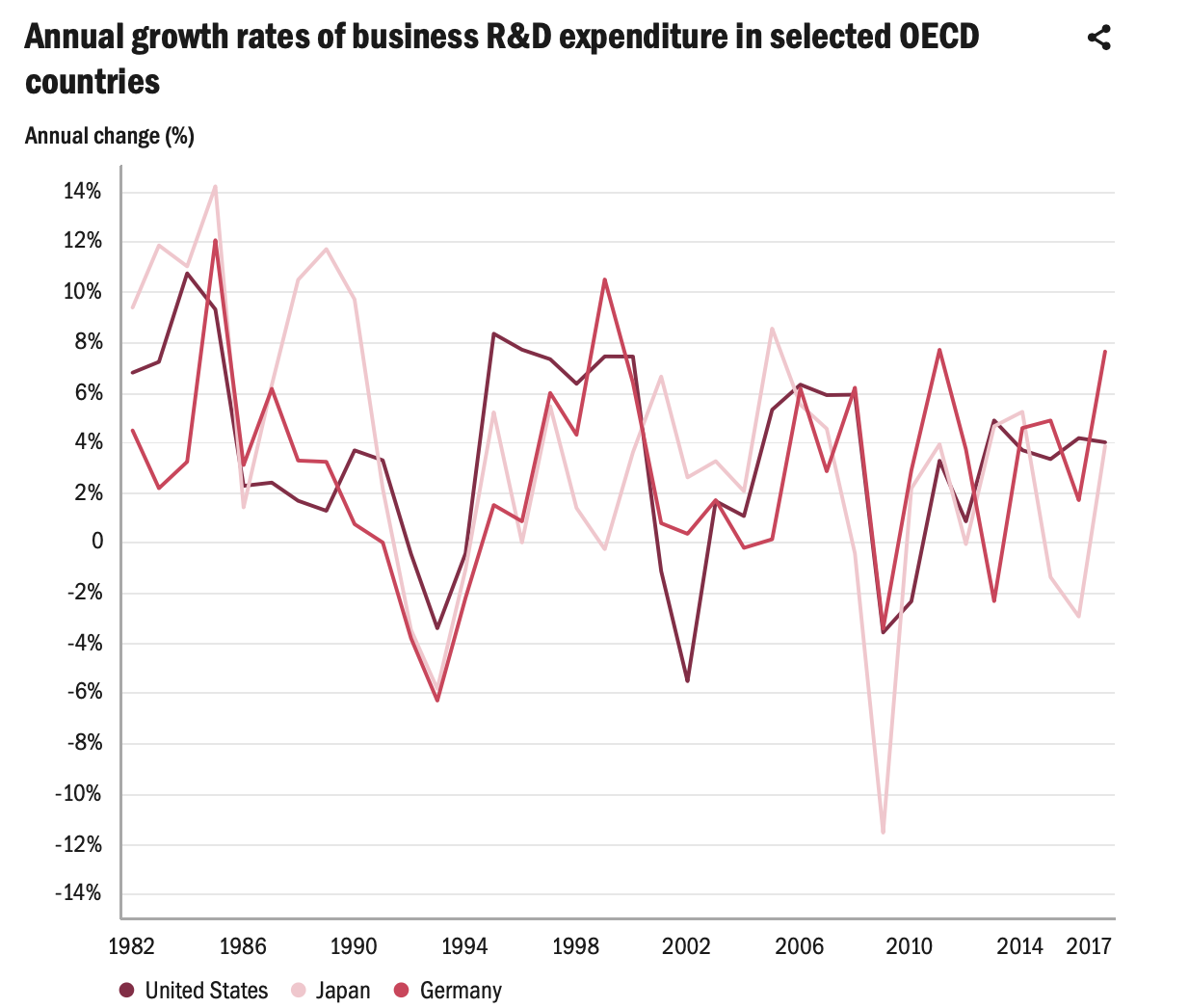

It is uncertain to what extent COVID-19 will influence incentives to carry out STI activities beyond those immediately related to the management of the health crisis and the supply of basic medical products. The impact of such activities on other areas will largely depend on how long the crisis lasts, when the uncertainty currently afflicting firms diminishes and growth expectations improve. Experiences from past crises suggest that corporate R&D spending is generally pro-cyclical. Periods of slow GDP growth such as 1992/93, 2000/02 or 2008/09 were accompanied by stagnating or falling business R&D expenditure. This pattern observed in the U.S., Germany and Japan (see Figure 3), can be explained by liquidity constraints, restrictive bank lending and shortfalls in demand during periods of recession, among others.6 7

However, they also found that employment in innovative companies tended to be more resilient to the consequences of the 2008/09 economic and financial crisis than those not engaged in innovation at all (see Figure 3). We have yet to determine the extent to which the economic recession triggered by COVID-19 will affect firms’ willingness to invest in R&D, and their ability to launch new products and services on the market. This time around, things might be more complicated than in previous crises, as firms tackle supply, demand and financial constraints simultaneously. A question mark remains on how long the extraordinary support for STI observed in several developing countries can last after COVID-19; moreover, can such support be expanded to other non-health-related research areas?

We have yet to determine the extent to which the economic recession triggered by COVID-19 will affect firms’ willingness to invest in R&D

An additional factor is that firms will find it difficult to mobilize innovation capacities in “home offices”. R&D is often tied to specific technical equipment such as laboratories or workshops, and is a highly collaborative process that requires people to work together. Even if the crisis frees up time for creativity, there may be a lack of means to translate this creativity into new products due to restrictions on public life. Difficulties accessing laboratories, equipment and cooperation partners at universities or in other companies will require an extra dose of creativity of both firms and policymakers.

Research and innovation policy during the crisis period should help prevent companies from delaying, or even discontinuing, innovation activities.

What policymakers can do

Research and innovation policy during the crisis period should help prevent companies from delaying, or even discontinuing, innovation activities. Policies combining direct and indirect financing and guarantees to compensate for expected liquidity constraints and restrictive bank lending are needed to offset, albeit partially, the risk of firms abandoning those activities, and stabilize future expectations. Policies should target small firms in particular, which tend to be most vulnerable to liquidity and financing problems. Many of these firms will require organizational restructuring, which is less technologically demanding but nonetheless a complicated endeavour in the face of liquidity constraints.

Strategic public procurement for innovation and investment in large, modern infrastructure development projects could help companies deal with shortfalls in demand. This approach is being observed in China, for example, where public expenditure is leading the post-COVID-19 recovery efforts through an ambitious programme of investment in the modernization of infrastructure, particularly energy, transport and information technology.10 This demand push should help mobilize a substantive base of domestic technological and manufacturing capabilities.

Learning from STI-community-led initiatives to pull available resources and efforts together in the fight against COVID-19 could facilitate policy design, informing about emerging research agendas and identifying technological ‘low-hanging fruits’ (Crowdfight COVID-19). At the same time, flexibility and speed will also be important in policy design and implementation. Responses to COVID-19 will likely generate innovations in unexpected areas. One example are digital online offers and delivery services in retail and restaurants. Companies that had already expanded their e-commerce abilities before the crisis could have a clear advantage here.

In line with the pledge of the 2030 Sustainable Development Agenda to leave no one behind, research and innovation policies in the post-COVID-19 period should avoid technological determinism. Support for social science research endeavours should shed light on the necessary direction of change to make recovery more equitable and sustainable, which includes distributional aspects of innovation—for example, around access to a COVID-19 vaccine—and the diversity of actors, interests and capabilities involved. Dedicated funding for research leading to strategies to manage recovery post-COVID-19 while taking into account societal inequalities and the need to enhance resilience to extreme events, seems to be a step in the right direction.11

Strategic public procurement for innovation and investment in large, modern infrastructure development projects could help companies deal with shortfalls in demand

Disclaimer: The views expressed in this article are those of the authors based on their experience and on prior research and do not necessarily reflect the views of UNIDO (read more).