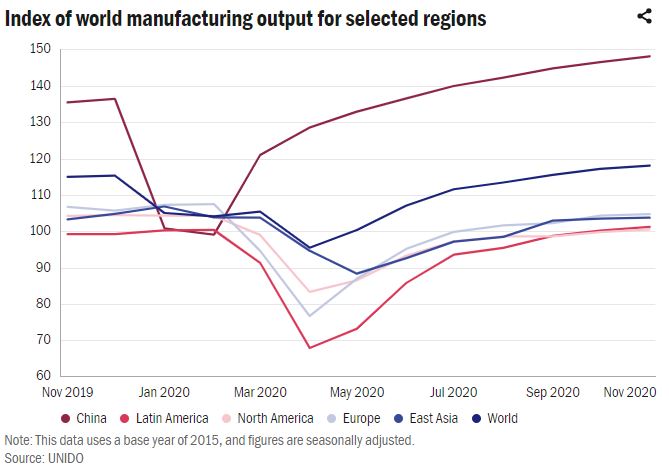

China’s manufacturing output had rebounded to pre-pandemic levels by June 2020, and has continued to rise.

Similar trends have also been observed in world manufacturing output. China’s production output may have been the first to be hit by strict virus containment measures, but the country also saw an early return to economic activity. Its manufacturing output had rebounded to pre-pandemic levels by June 2020, and has continued to rise since. In step with the international spread of COVID-19, the production output of other countries was curtailed around two months later. Economic recovery in these countries seems to be much slower than in China; two months after China’s manufacturing output returned to pre-pandemic levels, the rest of the world was still lagging behind. By November 2020, most regions had still not reached their pre-pandemic levels of production.

China’s strong economic recovery relative to other countries is even more starkly reflected at the industry level. The figure below shows year-over-year changes in output for November 2020 for five industries most relevant for China’s growth in industrial production, most of which are highly integrated in manufacturing GVCs. While output for these five industries increased significantly in China, the corresponding output in industrialized economies over the same period decreased in four out of five industries. Although manufacturing of computer, electronic and optical products in industrialized countries and across the world expanded in November 2020, their growth rates were still weaker than China’s.

China’s swift and strong recovery seems to indicate that Chinese firms are more resilient to global shocks than most others. In fact, the value chains that Chinese firms are deeply involved in seem to be more resilient. One reason for this might be China’s success in quickly containing the local spread of COVID-19. Another reason could be that the country has more regionalized value chains compared to other countries. China has become a particularly attractive investment destination and trading partner for neighbouring economies over the years, especially the Association of Southeast Asian Nations (ASEAN). It has also focused on building international economic relationships within its own neighbourhood through, for example, the Belt and Road Initiative, and the negotiation and conclusion of the Regional Comprehensive Economic Partnership (RCEP).

China’s deeper economic integration with ASEAN countries is evident in its trade data. According to UNCTAD data, the ASEAN bloc has become China’s largest trading partner, surpassing both the US and the EU (*4).

Regional Comprehensive Economic Partnership The RCEP is a free trade agreement between China, all ten ASEAN member states and five other Asia-Pacific economies, including Japan, the Republic of Korea and Australia. Signed on 15 November 2020, the agreement covers about a third of world population and almost 30 per cent of global GDP.

ASEAN as an export target region had been of increasing importance leading up to the pandemic, with year-over-year growth exceeding 20 per cent towards the end of 2019. This growth rate was much higher than that of China’s exports to many other major world markets, including the US, Japan and the EU.

Although China’s exports to ASEAN were also impacted by the containment measures associated with COVID-19, decreasing by about five per cent right at the beginning of 2020, they were less severely affected than China’s exports to the US, Japan and the EU. When China’s manufacturing output began recovering from the crisis in March 2020, its exports to ASEAN increased again and grew by more than 5 per cent in March/April 2020, and by more than 10 per cent from July/August to November/December 2020.

China’s increasingly regional focus will have implications for its traditional trading partners.

This apparent regionalization trend in China’s trade structure is expected to have implications for how GVCs might be recalibrated, with ripple effects for China’s traditional trading partners.

Balancing risks and opportunities

If highly specialized and interconnected GVCs become more spatially dispersed and regionalized, transport costs as well as vulnerabilities to global risks and supply chain disruptions may decrease. But strongly regionalized value chains may prevent firms and economies from efficiently allocating their scarce resources, from increasing their productivity or realizing higher potentials from specialization. Moreover, greater reliance on a more limited geographical area may reduce manufacturing firms’ flexibility, limiting their ability to find alternative sources and markets when hit by country- or region-specific shocks.

Changes in US imports from China can serve as an illustration of this point. Due to US-China trade tensions, US imports from China had been declining up until the first months of 2020. Yet reducing their reliance on China in favour of more regionalized value chains did not shield US firms from the economic shock the pandemic triggered. In fact, March/April 2020 saw a surge in US imports–in particular of medical supplies–from China, as the country scrambled to meet domestic demand (*5). This trend gained force as by November/December 2020 exports to the US grew at an extraordinary rate of over 40 per cent compared to same period in 2019.

Globalization at the crossroads

In spite of GVCs showing some degree of resilience in the face of the current global economic shock, the temporary (yet extensive) supply disruptions have induced many countries to reconsider the potential benefits of regionalizing or even localizing their value chains. These recent developments, together with the increasing power of emerging economies relative to advanced economies in trade issues and negotiations, make it difficult to predict how future GVCs can best be recalibrated, restructured and reorganized. Even though the roll-out of effective vaccines in 2021 may loosen the grip of COVID-19 on the global economy, ongoing protectionist and geopolitical trends suggest that the world is unlikely to see a return to business as usual. There is still a long and challenging way ahead.

We thank Muriel Rotermund for her research support, as well as Aiden Selsick and Niki Rodousakis for their editorial guidance.

Note: This article was updated with new data early February 2021.

- Adnan Seric is Research and Industrial Policy Officer at the Department of Policy Research and Statistics (PRS) of UNIDO.

- Holger Görg is Professor of International Economics at the University of Kiel and Head of the Research Area “Global Division of Labour” at the Kiel Institute for the World Economy (IfW Kiel). He is also Director of the Kiel Centre for Globalization.

- Wan-Hsin Liu is Senior Researcher at the Kiel Institute for the World Economy (IfW Kiel) and Coordinator of the Kiel Centre for Globalization.

- Michael Windisch is Junior Specialist on Industrial Development at the Department of Policy Research and Statistics (PRS) of UNIDO.